VOLUME VlL-JULY TO DECEMBER, 1844.

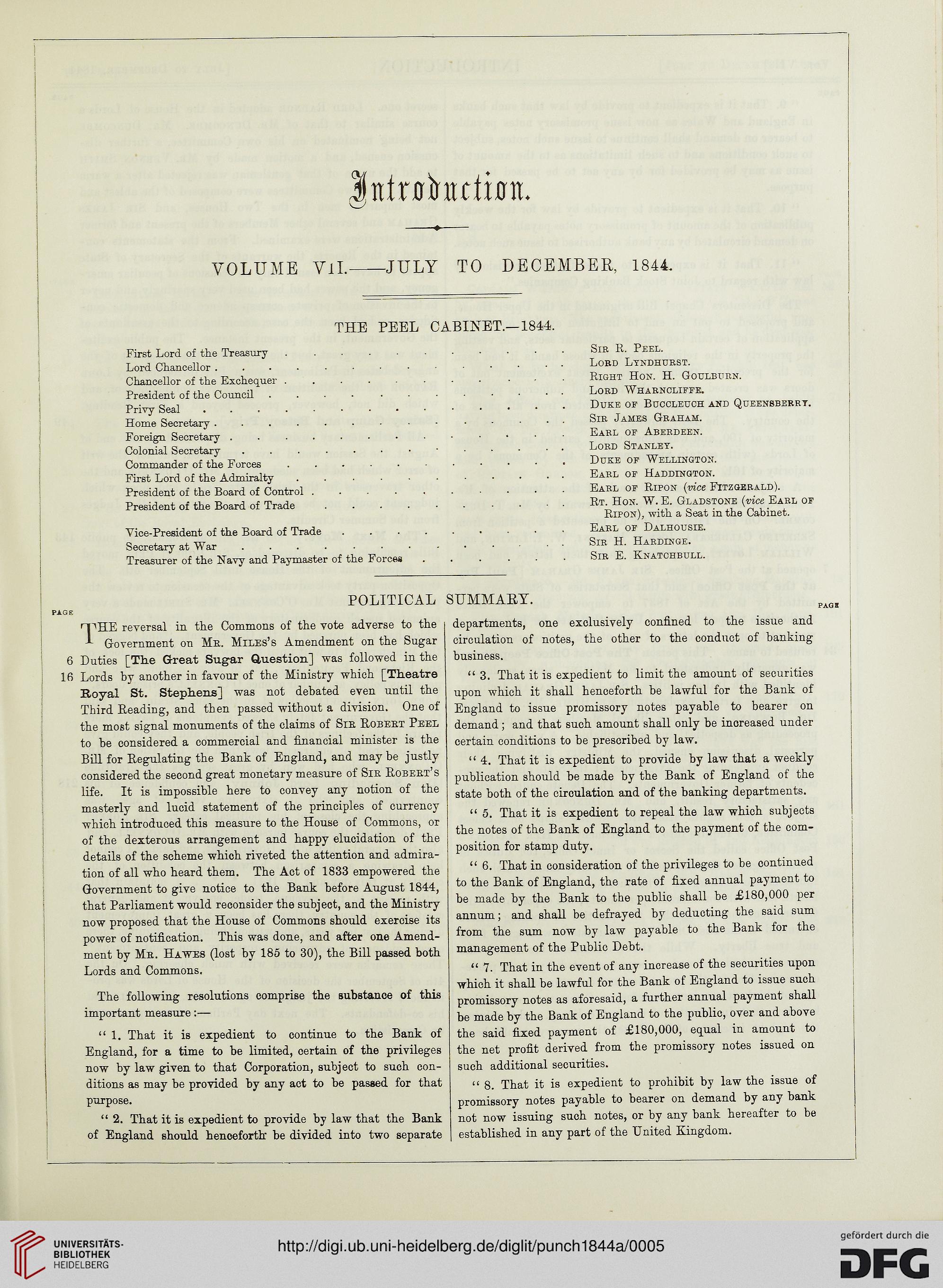

THE PEEL CABINET.—1844.

First Lord of the Treasury........... Sir R. Peel.

Lord Chancellor.............. Lord Lyndhurst.

Chancellor of the Exchequer........... Right Hon. H. Goulburn.

President of the Council............ Lord Wharncliffe.

Privy Seal.............. Duke of Bdccledch and Qdeensberrt.

Home Secretary........ -..... Sir James Graham.

Foreign Secretary............. Earl of Aberdeen.

Colonial Secretary.......•..... Lord Stanley.

Commander of the Forces........... Duke op Wellington.

First Lord of the Admiralty........... Earl of Haddington.

President of the Board of Control.......... Earl of Ripon {vice Fitzgerald).

President of the Board of Trade.......... Rt. Hon. W. E. Gladstone {vice Earl of

Ripon), with a Seat in the Cabinet.

Vice-President of the Board of Trade......... Earl of Dalhousie.

Secretary at War............. Sir H. Hardinge.

Treasurer of the Navy and Paymaster of the Forces...... Sir E. Knatchbull.

POLITICAL

HTHE reversal in the Commons of the vote adverse to the

Government on Me. Miles's Amendment on the Sugar

6 Duties [The Great Sugar Question] was followed in the

IB Lords by another in favour of the Ministry which [Theatre

Royal St. Stephens] was not debated even until the

Third Reading, and then passed without a division. One of

the most signal monuments of the claims of Sie Robert Peel

to be considered a commercial and financial minister is the

Bill for Regulating the Bank of England, and may be justly

considered the second great monetary measure of Sir Robeet's

life. It is impossible here to convey any notion of the

masterly and lucid statement of the principles of currency

which introduced this measure to the House of Commons, or

of the dexterous arrangement and happy elucidation of the

details of the scheme which riveted the attention and admira-

tion of all who heard them. The Act of 1833 empowered the

Government to give notice to the Bank before August 1844,

that Parliament would reconsider the subject, and the Ministry

now proposed that the House of Commons should exercise its

power of notification. This was done, and after one Amend-

ment by Me. Hawes (lost by 185 to 30), the Bill passed both

Lords and Commons.

The following resolutions comprise the substance of this

important measure:—

"1. That it is expedient to continue to the Bank of

England, for a time to be limited, certain of the privileges

now by law given to that Corporation, subject to such con-

ditions as may be provided by any act to be passed for that

purpose.

" 2. That it is expedient to provide by law that the Bank

of England should henceforth be divided into two separate

SUMMABY.

departments, one exclusively confined to the issue and

circulation of notes, the other to the conduct of banking

business.

" 3. That it is expedient to limit the amount of securities

upon which it shall henceforth be lawful for the Bank of

England to issue promissory notes payable to bearer on

demand ; and that such amount shall only be increased under

certain conditions to be prescribed by law.

" 4. That it is expedient to provide by law that a weekly

publication should be made by the Bank of England of the

state both of the circulation and of the banking departments.

" 5. That it is expedient to repeal the law which subjects

the notes of the Bank of England to the payment of the com-

position for stamp duty.

" 6. That in consideration of the privileges to be continued

to the Bank of England, the rate of fixed annual payment to

be made by the Bank to the public shall be £180,000 per

annum; and shall be defrayed by deducting the said sum

from the sum now by law payable to the Bank for the

management of the Public Debt.

" 7. That in the event of any increase of the securities upon

which it shall be lawful for the Bank of England to issue such

promissory notes as aforesaid, a further annual payment shall

be made by the Bank of England to the public, over and above

the said fixed payment of £180,000, equal in amount to

the net profit derived from the promissory notes issued on

such additional securities.

" 8. That it is expedient to prohibit by law the issue of

promissory notes payable to bearer on demand by any bank

not now issuing such notes, or by any bank hereafter to be

established in any part of the United Kingdom.

THE PEEL CABINET.—1844.

First Lord of the Treasury........... Sir R. Peel.

Lord Chancellor.............. Lord Lyndhurst.

Chancellor of the Exchequer........... Right Hon. H. Goulburn.

President of the Council............ Lord Wharncliffe.

Privy Seal.............. Duke of Bdccledch and Qdeensberrt.

Home Secretary........ -..... Sir James Graham.

Foreign Secretary............. Earl of Aberdeen.

Colonial Secretary.......•..... Lord Stanley.

Commander of the Forces........... Duke op Wellington.

First Lord of the Admiralty........... Earl of Haddington.

President of the Board of Control.......... Earl of Ripon {vice Fitzgerald).

President of the Board of Trade.......... Rt. Hon. W. E. Gladstone {vice Earl of

Ripon), with a Seat in the Cabinet.

Vice-President of the Board of Trade......... Earl of Dalhousie.

Secretary at War............. Sir H. Hardinge.

Treasurer of the Navy and Paymaster of the Forces...... Sir E. Knatchbull.

POLITICAL

HTHE reversal in the Commons of the vote adverse to the

Government on Me. Miles's Amendment on the Sugar

6 Duties [The Great Sugar Question] was followed in the

IB Lords by another in favour of the Ministry which [Theatre

Royal St. Stephens] was not debated even until the

Third Reading, and then passed without a division. One of

the most signal monuments of the claims of Sie Robert Peel

to be considered a commercial and financial minister is the

Bill for Regulating the Bank of England, and may be justly

considered the second great monetary measure of Sir Robeet's

life. It is impossible here to convey any notion of the

masterly and lucid statement of the principles of currency

which introduced this measure to the House of Commons, or

of the dexterous arrangement and happy elucidation of the

details of the scheme which riveted the attention and admira-

tion of all who heard them. The Act of 1833 empowered the

Government to give notice to the Bank before August 1844,

that Parliament would reconsider the subject, and the Ministry

now proposed that the House of Commons should exercise its

power of notification. This was done, and after one Amend-

ment by Me. Hawes (lost by 185 to 30), the Bill passed both

Lords and Commons.

The following resolutions comprise the substance of this

important measure:—

"1. That it is expedient to continue to the Bank of

England, for a time to be limited, certain of the privileges

now by law given to that Corporation, subject to such con-

ditions as may be provided by any act to be passed for that

purpose.

" 2. That it is expedient to provide by law that the Bank

of England should henceforth be divided into two separate

SUMMABY.

departments, one exclusively confined to the issue and

circulation of notes, the other to the conduct of banking

business.

" 3. That it is expedient to limit the amount of securities

upon which it shall henceforth be lawful for the Bank of

England to issue promissory notes payable to bearer on

demand ; and that such amount shall only be increased under

certain conditions to be prescribed by law.

" 4. That it is expedient to provide by law that a weekly

publication should be made by the Bank of England of the

state both of the circulation and of the banking departments.

" 5. That it is expedient to repeal the law which subjects

the notes of the Bank of England to the payment of the com-

position for stamp duty.

" 6. That in consideration of the privileges to be continued

to the Bank of England, the rate of fixed annual payment to

be made by the Bank to the public shall be £180,000 per

annum; and shall be defrayed by deducting the said sum

from the sum now by law payable to the Bank for the

management of the Public Debt.

" 7. That in the event of any increase of the securities upon

which it shall be lawful for the Bank of England to issue such

promissory notes as aforesaid, a further annual payment shall

be made by the Bank of England to the public, over and above

the said fixed payment of £180,000, equal in amount to

the net profit derived from the promissory notes issued on

such additional securities.

" 8. That it is expedient to prohibit by law the issue of

promissory notes payable to bearer on demand by any bank

not now issuing such notes, or by any bank hereafter to be

established in any part of the United Kingdom.